Chinese Democracy?

Some Caveats

The Plague

QE Infinity

The Stimulus

A classic bailout!

State Capitalism?

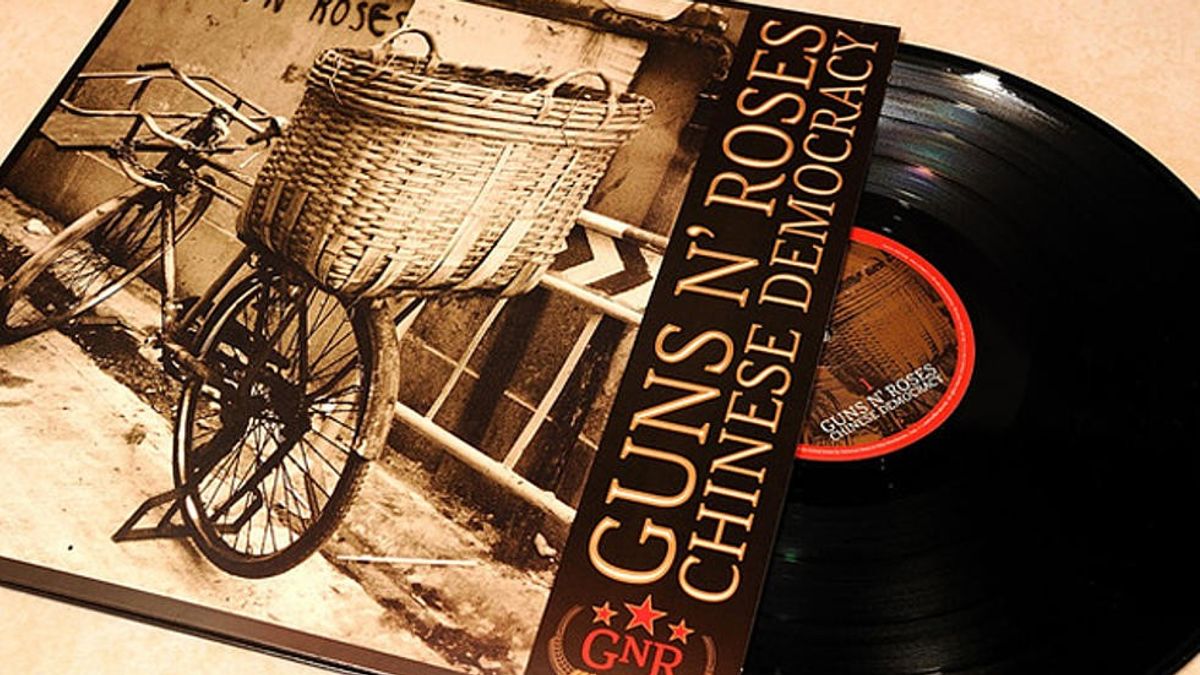

"After years of waiting, it seems that Chinese Democracy is finally upon us! But rather than being a new political movement, it turns out it's just a really, really late album from Guns N' Roses. Who knew Axl Rose was such a perfectionist? At this rate, we'll probably be getting a follow-up album called 'Tibetan Monarchy' in 2045.

#PatienceIsAVirtue"

Some Caveats

First, I want to clarify my interpretation of this term. Chinese Democracy, I think, most closely resembles State Capitalism Lite, a form of quasi-monopolistic capital controls where the principal actor roles are shifted from corporations to the government.

Chinese Democracy akin to State Capitalism?

The Plague

The events over the last many weeks as a result of the COVID-19 pandemic has changed our lives on multiple levels. It's not quite "The Plague" or the "Spanish Flu" (yet), but it sure is something that is "Right Next Door to Hell"! Terms like shelter-in-place, mutation, cytokines, antibodies, lockdowns, flattening the curve, social distancing, social Darwinism, monetary stimulus, fiscal stimulus and a host of others are now a part of our day-to-day vocabulary. Heck, my 13-year-old was asking me if the fiscal stimulus was passed already! Interestingly, and rightly so, the government has taken center stage and has intervened to fix the problem in ways that we have not seen in our lifetimes.

QE Infinity

For example, to prevent a credit crisis, the Fed dropped interest rates to zero and has pumped in trillions of dollars as a backstop measure to provide liquidity in the market.

QE Infinity, a whatever it takes backstop!

The dash for cash over the past month has meant that everything was for sale - gold, Treasuries, mortgage-backed securities, munis, corporate bonds, stocks (and I am missing a few, but you get the picture) - everything. In this mad run on the banks, at a certain juncture, there was nobody left to buy securities from the incremental sellers. Consequently, if the Fed hadn't intervened, deleveraging margin calls could have widened bid-ask spreads (which they did in some cases) and a sick market would have slipped into a "Coma".

The Stimulus

The government has also implemented a massive 2 trillion dollar fiscal stimulus package, the largest one in history, to bail out distressed industries with solvency issues and to hand out checks to citizens in desperate need for liquidity post furloughs and layoffs. Given the hospital situation (900k beds, 600k utilized, lack of ventilators), if they can't flatten the curve fast enough, they need to do more (another $3-5 trillion) for the citizens to literally prevent social unrest and a not so implausible "Civil War". These actions, absolutely necessary in these times, will be financed through bond issuances, printing money and future "I.R.S." receipts which unfortunately implies that the future generations will pay a price for today's deficits and indebtedness.

Now let's understand how the Fed's and Uncle Sam's moves mimic the policy actions taken by the People's Bank of China (PBoC). Even before COVID-19 hit, Chinese banks were over-leveraged, under-capitalized, and burdened with non-performing loans. Post the 2008 crisis, like a "Bad Obsession", China went on a credit binge, as a consequence of which, the PBoC had to bail these banks out in 2019. Swap lines were used to buy subsidiary banks' perpetual bonds, which as the name suggests, don't have to be repaid, so in reality, they are nothing but equity. So the PBoC took equity positions in the banks, that was, in fact, equal in seniority to secured credit. Think of this as similar to debtor-in-possession (DIP) financing, except the financing instrument is not debt, but equity! Now get this. Since most of the businesses in China are "owned" by the banks a.k.a the State, the perpetual bonds on the banks' balance sheet essentially were nothing but zombie equity positions in the most levered businesses in the Chinese economy! Does anyone see any expropriation risk here? Does this reek of nationalization?

"Welcome to the Jungle"!

A classic bailout!

In the COVID-19 era, while the PBoC didn't cut rates as aggressively as initially feared, they cut the amount of cash that banks have to set aside as reserves, offered discounts to commercial lenders’ reserve ratios and restarted open market operations to offer sufficient liquidity to help banks. The PBoC offered 100 billion yuan ($14.3 billion) via the one-year medium-term lending facility, keeping the rate unchanged at 3.15% and issued 209.5 billion yuan in bonds to fight the virus, thus preventing a "Breakdown" of the financial system. Ergo, by lending to the banks, they in fact indirectly increased their ownership stakes in Chinese businesses.

Bailout!

Next, on the fiscal front, China ordered local governments to offer unemployment subsidies and extended credit to stressed companies. Keeping people employed is a priority for China’s leadership, which has resulted in them forcing people to get back to work and this is to be expected in the Chinese State (is the second wave of infections coming?). Is this a case of "Live and Let Die"?

Said differently, the bourgeoisies live and the proletariat dies?

Isn't this the genesis of revolutions? Mind you, the Easter (April 12) opening up of the US economy comment made by our "Double Talking Jive" may lead us to that point of no return.

Back to our own government, instead of going directly through the bank balance sheets this time, they have instantiated a stimulus package that takes equity-like positions in over-levered, distressed "Bad Apples" that need a cash infusion. Companies that have bought back billions of dollars of their own stock and inflated earnings per share numbers to enrich a few at the top. Uncle Sam does indeed have "Sympathy for the Devil". The US has in part, and it pains me to say this, quasi-nationalized some of these industries (a la China) and stands to make a killing once the economy recovers. Nothing wrong with that at all, but then call it what it is. It's not a free-market, it's not capitalism, it is State Capitalism.

State Capitalism?

Noam Chomsky has used this term State Capitalism to describe economies where large corporations that are deemed "too big to fail" receive publicly funded government bailouts (US taxpayer dollars from you and me) that undermine market laws, and where private production is largely funded by the state at public expense, but private owners (CEOs and large shareholders) reap the profits. "Anything Goes"!

So I ask ...

Is America A Chinese Democracy?

No right answers to this one but something to think about and foment debate. At the very least, looking for a little bit of levity during these trying times? Look no further than the Chinese Democracy movement - where the only thing being overthrown is the notion that you can't have your dumplings and eat them too.

Text in "bold" are some of my GNR favorites!

Share This