Archive

AI: Quest for Consciousness

Substrate independence is the idea that the intelligence of an entity is not dependent on its physical substrate, or the matter and energy that make it up. In other words, an intelligent entity could be made of anything, as long as it has the right computational properties.

August 8th, 2023

The Numbers Behind AI

Substrate independence signifies the liberation of AI from the constraints of hardware and software, envisioning a future where intelligence can seamlessly transcend diverse platforms. This paradigm shift promises to revolutionize industries, enhance accessibility, and accelerate innovation, while challenging our conventional understanding of AI's limitations.

August 8th, 2023

Long Short Investing: The 2022 Winner and Future Prospects

Long short investing, a strategy that involves taking both long and short positions in the stock market, has been a consistently profitable investment strategy for many years. In 2022, this strategy proved to be particularly successful, and there are several reasons why it is likely to continue to be a winner for the foreseeable future.

January 1st, 2023

Nuclear Fusion: Harnessing the Power of the Sun

December 13, 2022 will forever be etched as a seminal moment in the world of nuclear physics. The day will be remembered for an epoch-making event where laboratory scale nuclear fusion was declared successful, paving the way as a potential path towards green, non-polluting energy for earth and its inhabitants.

December 12th, 2022

FTX Goes Belly Up: Time to Rethink Crypto Exposure?

Sam Bankman-Fried’s crypto empire filed for Chapter 11 bankruptcy in Delaware, capping a rapid downfall for the crypto wunderkind.

November 11th, 2022

99rises ZeroCarbon: A Blockbuster Performance

99rises was created with the sole purpose to help you reach your goals by investing in your values without sacrificing returns.

November 11th, 2022

99rises Performance: Return of Capital Wins

Bear markets are brutal. We are in one right now and one of the best ways to survive is to allocate capital to two-sided long-short strategies employed by hedge funds.

November 11th, 2022

A Generational Energy Crisis in Europe

Energy security concerns in Europe amid the Russia-Ukraine conflict has driven a parabolic surge in prices that has devastated European and emerging world economies.

October 10th, 2022

Measuring Long-Short Portfolio Performance

Portfolio performance measures are a key factor in the investment decision. Portfolio returns are only part of the story. Without evaluating risk-adjusted returns, an investor cannot possibly see the whole investment picture.

April 4th, 2022

End of the 'Goldilocks' Economy

A Goldilocks economy describes an ideal steady state for an economy whereby the economy is not expanding or contracting by too much. A Goldilocks economy has predictable economic growth, preventing a recession, but not so much growth that inflation spikes.

April 4th, 2022

A Portfolio Rethink

The 60/40 asset allocation mantra is dead. Long live 60/40. For the longest time, financial advisors constructed portfolios that were comprised of 60% stocks and 40% bonds or fixed income instruments. But the rising uncertainty due to rising inflation and interest rates, volatile markets, a spate of damaging geopolitical and climatic events, and increased awareness of social inequality has put a dent in this asset allocation methodology.

March 3rd, 2022

How Macroeconomic Factors Affect Stock Markets

A core foundation of behavioral finance theory is that markets trade on sentiment and are therefore not efficient. This theory posits that rather than being rational and calculating, people often make decisions based on emotions and cognitive biases. Macroeconomic factors play a key role in influencing investor psyche, and thus on market movements.

March 3rd, 2022

EVs and Surging Oil Prices

Energy transition is in the cross hairs of oil prices going parabolic. While some say rising oil prices make energy transition investments economically competitive, there is another school of thoughts that suggests that surging oil prices present a much bigger threat to ESG and its constant need to justify its relevance with outperformance.

March 3rd, 2022

What is Modern Monetary Theory (MMT)?

The central idea of MMT is that governments with a fiat currency system under their control can and should print as much money as they need to spend because they cannot go broke or be insolvent unless a political decision to do so is taken.

March 3rd, 2022

What is Hedging?

Simply put, hedging is defined as either buying or selling an investment instrument or security to reduce the risk of losses from another portfolio or investment.

February 2nd, 2022

Printing Trillions: The Tale of a Burning Platform

At no other point since at least 1999 have so many stocks been cut in half while the Nasdaq Composite index was so close to its peak. There is no precedent for when so many stocks were in a bear market, and the index wasn’t. Valuations are at highs, companies are raising billions based on fairy dust, and the Fed is signaling a tightening cycle. Are we on the cusp of a repeat of 1999-2000? Are the after-effects of printing trillions about to hit?

February 2nd, 2022

The Inverted Yield Curve

The yield curve is a graph of the interest rate on bonds as a function of time to maturity. Normally, long-term interest rates are higher than short-term interest rates to compensate for the greater riskiness of the unknown. But sometimes, the situation reverses, and short rates rise above long rates, and the yield curve is said to be inverted.

February 2nd, 2022

The Meme Frenzy Retreat

Last year, it was really a tale of two stock markets - the one that was rational and valued companies based on cash flows and then you had a complete casino society. The meme-stock frenzy was a speculative bubble, an unmitigated disaster waiting to unfold, taking with it shores of retail traders.

February 2nd, 2022

Portfolio Diversification via Alternative Investments

Alt investing has its merits. Using alt strategies to maximize investment upside and insure against market corrections is an often ignored allocation for most retail investors.

January 1st, 2022

Don't Fight the Fed

The Fed tightening is playing out, as liquidity removal since the start of the year has been driven by the bond market sell-off and equity weakness. Just because the Nasdaq is off 12% from the Dec highs, it doesn't mean that the tightening is close to being done.

January 1st, 2022

What is Long-Short Investing?

An equity long-short strategy is one that involves taking long positions in stocks that are expected to increase in value and short positions in stocks that are expected to decrease in value.

October 10th, 2021

Factor Investing: The Momentum Vector

The “momentum” or the “mo” vector is the velocity of price changes in any tradable asset like equities. Mathematically speaking, it is the first derivative of the price changes with respect to time and helps investors understand trend signals.

September 9th, 2021

A Minsky Moment or an LTCM Instance?

Hong Kong is gripped by the fast-developing debt crisis at real estate developer China Evergrande Group, which is on the brink of skipping interest payments to banks. This has translated into a nasty selloff in Hong Kong, which has seen the Hang Seng Chinese Enterprises Index touch its low from the pandemic shutdown.

August 8th, 2021

Afterpay Aftermath Afterwards

Buy now, pay later contracts are point-of-sale installment loans that allow consumers to make purchases and pay for them at a future date. Consumers typically make an upfront payment toward the purchase, then pay the remainder off in a predetermined number of installments.

July 7th, 2021

Shipwrecked or Cruisified?

Nobody in their right minds would want to go on cruises after the hell passengers have had to endure. The debacles on the Grand Princess, Diamond Princess and others due to the COVID-19 outbreaks have left people the world over with a very different vision of what a cruise experience can be.

May 5th, 2020

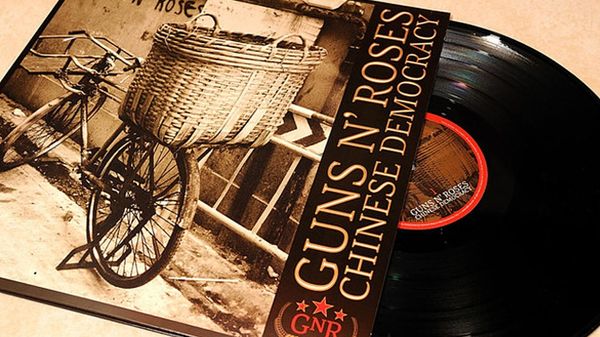

Chinese Democracy?

If you are a big fan of Guns N' Roses, I am pretty sure you've listened to their album "Chinese Democracy", incidentally released in November 2008 at the height of the mortgage crisis. Great song, not in the same ilk as one of their classics, but that's not the point. I wanted to invoke the phrase and perhaps delve deeper into what that means today.

April 4th, 2020

Zeros or Zeroes?

Central banks across the world, collectively and extraordinarily have engaged in loose monetary policies for the better part of the last decade. Globally, there's anywhere between $12-$15 trillion of negative-yielding debt and the US is hurtling toward's this point of no return.

April 4th, 2020

Don't Run Out Of Energy!

Value investors are screaming energy is cheap! And although fossil-fuels are bastardized due to the impending EV wave about to sweep the world and the Greta Thunberg effect (and rightly so), they still very much form the basic fabric of our daily lives.

March 3rd, 2020

The Passive Investment Bubble

"A turkey is fed for 1,000 days by a butcher, and every day confirms to the turkey and the turkey's economics department and the turkey's analytical department that the butcher loves turkeys, and every day brings more confidence to the statement. But on day 1,001, there will be a surprise for the turkey ..."

-- Professor Nassim Nicholas TalebMarch 3rd, 2020

The Powell Put: Should the Fed Cut Rates?

To cut or not to cut is the question. A biological shock, an outbreak such as COVID-19 can have undefined boundary conditions. Nobody really knows the lasting effects or the duration of this pandemic. It is this very uncertain nature of this event that demands caution and careful monitoring from the Fed.

February 2nd, 2020